- ORIGINAL NEWS

States have been eliminating taxes on period products for years. Here’s where you’ll still pay them.

- SUMMARY

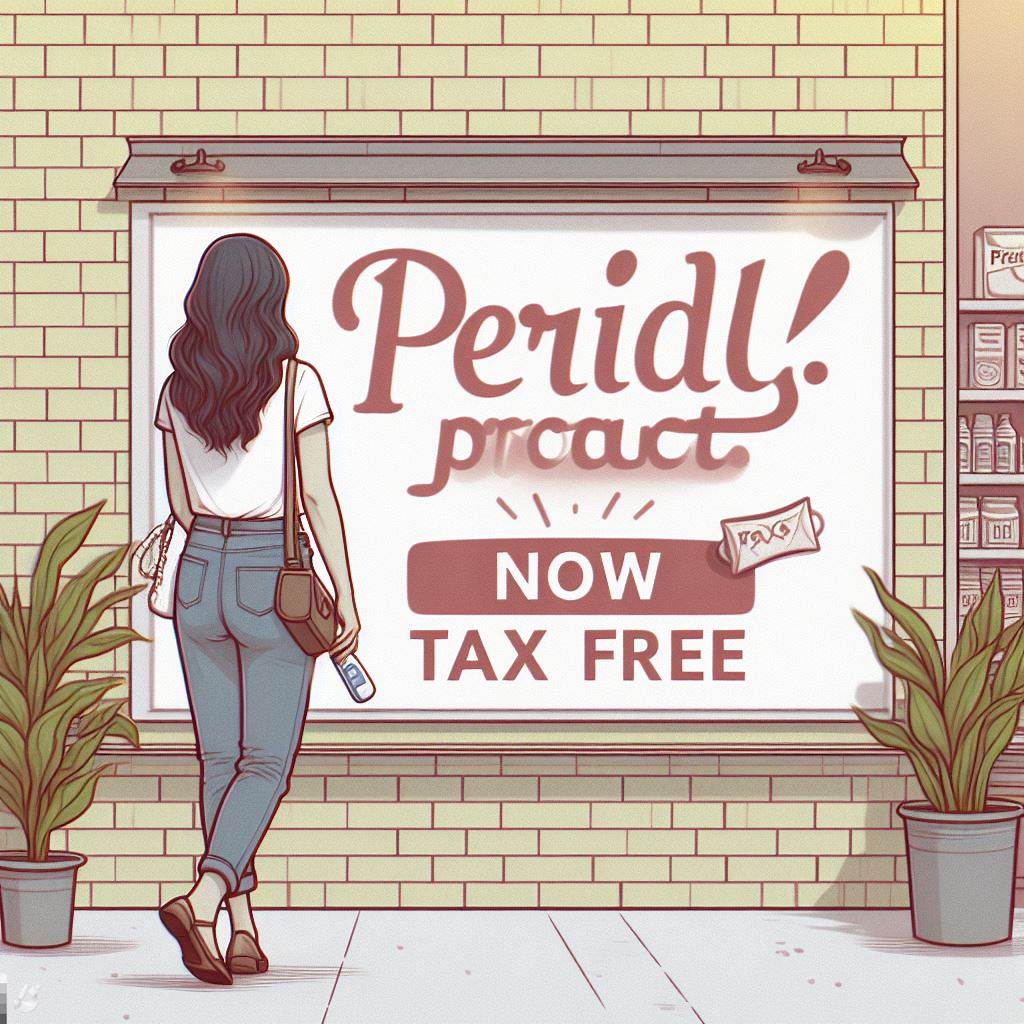

In numerous states across the United States, period products, such as tampons and pads, are subject to a sales tax, making them more expensive for individuals who menstruate.

This “tampon tax” is considered a luxury tax, despite the fact that period products are essential for maintaining personal hygiene and health.

Over the last few decades, there has been a movement to eliminate the tampon tax in various states.

Minnesota was the first state to do so in 1981, and 23 other states, along with Washington D.C., have followed suit.

Recently, Texas and Kentucky have introduced bills aimed at waiving the tampon tax.

Advocates for eliminating the tampon tax argue that period products are essential goods and should not be taxed as luxury items.

They also point out that the tax disproportionately affects low-income individuals and communities of color, who may struggle to afford these products.

There are still obstacles to eliminating the tampon tax nationwide, such as concerns about revenue loss and the need for additional funding to provide free period products in schools and public restrooms.

However, advocates are pushing for continued progress in making period products more accessible and affordable for all.

- NEWS SENTIMENT CHECK

- Overall sentiment:

positive

Positive

“In 21 states, a sales tax of between 4% and 7% applies to items like pads and tampons, making them more costly, data from the Alliance for Period Supplies show.”

“Approximately a quarter of teens and a third of adults reported having trouble affording period products in a 2023 survey from the underwear brand Thinx and the nonprofit organization PERIOD.”

“Over the last four decades, states with sales tax have been enacting laws that eliminate such taxes on menstrual products.”

“More from NBC NewsAntisemitic incidents in the U.S. jumped 360% after Oct.7 Hamas attack, advocacy group saysChina tells U.S. it will ‘never compromise’ on Taiwan as the island’s election draws nearBiden to head to Michigan and Nevada to ramp up outreach to key base voters”

Negative

“Over a lifetime, period products in the U.S. cost a total of around $6,000 per person, according to research published in 2021 — and that’s before tax.”

“Public health experts see period products as essential goods: If they’re harder to find or afford, people may stretch a particular product’s use longer, which can raise the risk of infection or toxic shock syndrome — a rare, life-threatening condition. “

“There are still several obstacles to eliminating the tampon tax nationwide.”