- ORIGINAL NEWS

‘The 30-year fixed-rate mortgage is a uniquely American construct,’ analyst says. Here’s why

- SUMMARY

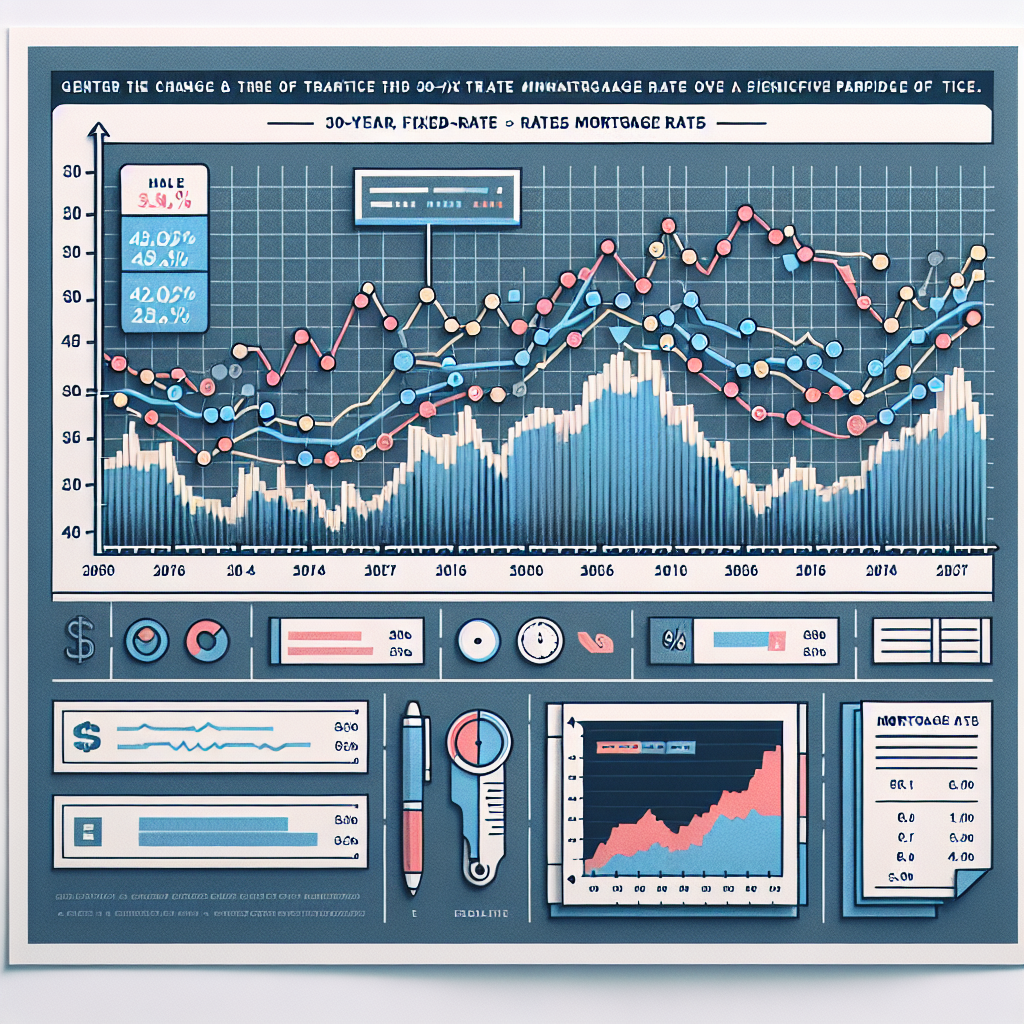

The United States has a unique advantage in the mortgage market, offering long-term, fixed-interest-rate loans through the 30-year fixed-rate mortgage.

This stability stands out in the global landscape where homeowners often face shorter-term fixed-rate mortgages or variable rates.

The backbone of the 30-year fixed-rate mortgage lies in the deep financial markets and mortgage-backed securities (MBS).

MBS involve packaging mortgages and selling them to investors, providing a steady stream of income and managing the risk associated with interest rate fluctuations.

Government-sponsored institutions Fannie Mae and Freddie Mac play a crucial role by insuring MBS, making them attractive to investors and enabling lenders to take on the risk of interest rate changes.

The resulting fixed interest rate remains constant throughout the loan’s life, regardless of market shifts.

In contrast, other countries typically have fixed-rate mortgages for shorter periods, such as 5 or 25 years, or variable rates where the interest rate can change over time.

In these cases, homeowners may have to refinance more frequently or bear the risk of interest rate changes, which can impact their monthly payments.

The availability of the 30-year fixed-rate mortgage in the United States has a significant impact on homeowners, bringing stability and predictability to their housing costs over the long term.

- NEWS SENTIMENT CHECK

- Overall sentiment:

positive

Positive

“The 30-year fixed-rate mortgage is a uniquely American construct, said Greg McBride, chief financial analyst for Bankrate.”

“About half of all mortgages originated in the U.S. will end up packaged into a mortgage-backed security and sold to bond investors, he said.”

Negative

“Mortgage-backed securities were at the heart of the financial crisis and Great Recession, improvements have been made to avoid the risk.”

“In most other countries, [that risk] gets passed through to the households, the buyers,”