- ORIGINAL NEWS

The great wealth transfer has started — but millennials, Gen Z may not inherit as much as they anticipate

- SUMMARY

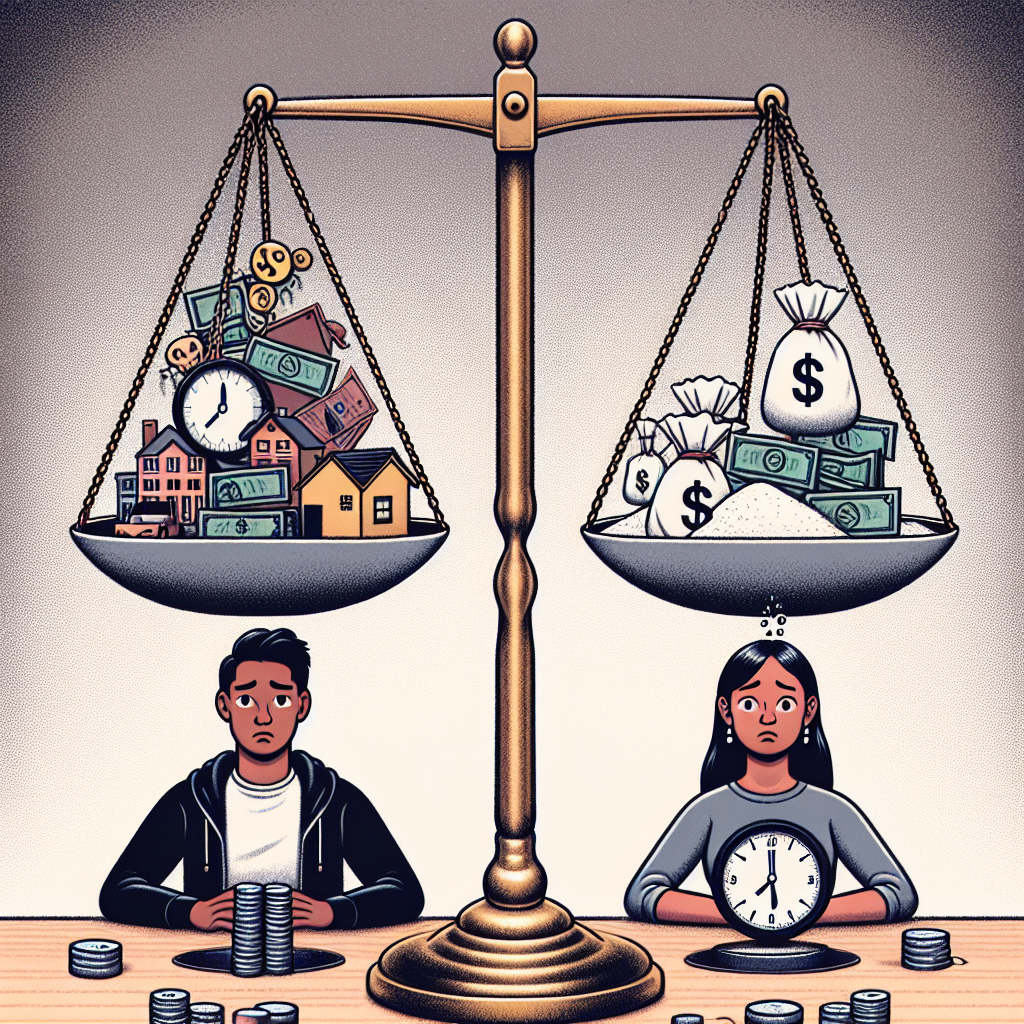

A widening gap exists between the inheritances millennials and Generation Z expect to receive from their aging parents, and the actual amounts those parents plan on leaving.

This discrepancy stems from factors such as: * Increased lifespans leading to higher healthcare costs and financial insecurity among older adults.

* Changing societal attitudes toward inheritance, with some viewing it as a less reliable source of wealth.

BlackRock’s Elizabeth Koehler predicts a significant “wealth transfer” of over $68 trillion from Baby Boomers to younger generations.

However, millennials and Gen Z may not receive as much as they anticipate.

Research has shown that 68% of millennials and Gen Zers expect inheritances of around $320,000, while 52% anticipate even larger amounts close to $350,000.

Conversely, 55% of Baby Boomers planning on leaving inheritances intend to pass on less than $250,000.

This disparity is attributed to a lack of communication between aging parents and their adult children about financial matters.

Other factors include inflation, rising healthcare expenses, and increased financial insecurity among older Americans.

Despite these challenges, millennials could potentially become the “richest generation in history” thanks to the intergenerational wealth transfer.

However, they also face significant financial headwinds such as higher living costs and elevated student loan debt.

To bridge the inheritance gap, it’s crucial for parents and adult children to have open and transparent conversations about financial plans, including amounts, distribution methods, and family values related to inheritance and philanthropy.

A worrying trend is that 90% of parents intend to leave inheritances but only 48% have a specific plan in place.

This lack of planning highlights the importance of creating a clear roadmap for the transfer of assets to ensure the younger generation’s financial well-being.

- NEWS SENTIMENT CHECK

- Overall sentiment:

negative

Positive

“Baby boomers are set to pass more than $68 trillion on to their children.”

“Over the next decade this intergenerational transfer could make millennials ‘the richest generation in history’.”

Negative

“Studies show a disconnect between how much adult children expect to inherit and how much their aging parents plan on leaving them.”

“Just one-third of white families and about one in every 10 Black families receive any inheritance at all, and more than half of those inheritances will amount to less than $50,000.”

“Overall, fewer Americans are feeling financially confident these days, a report by Edelman Financial Engines found, and just 14% would consider themselves wealthy.”

“Not only are their wages lower than their parents’ earnings when they were in their 20s and 30s, after adjusting for inflation, but they are also carrying larger student loan balances, recent reports show.”

“That makes it even more important to map out how that money will be handed down as well as exactly how much will change hands, Barrow said, in addition to discussing it as a family.”