- ORIGINAL NEWS

Steve Eisman says the Fed shouldn’t cut rates, risks creating a stock market bubble if it does

- SUMMARY

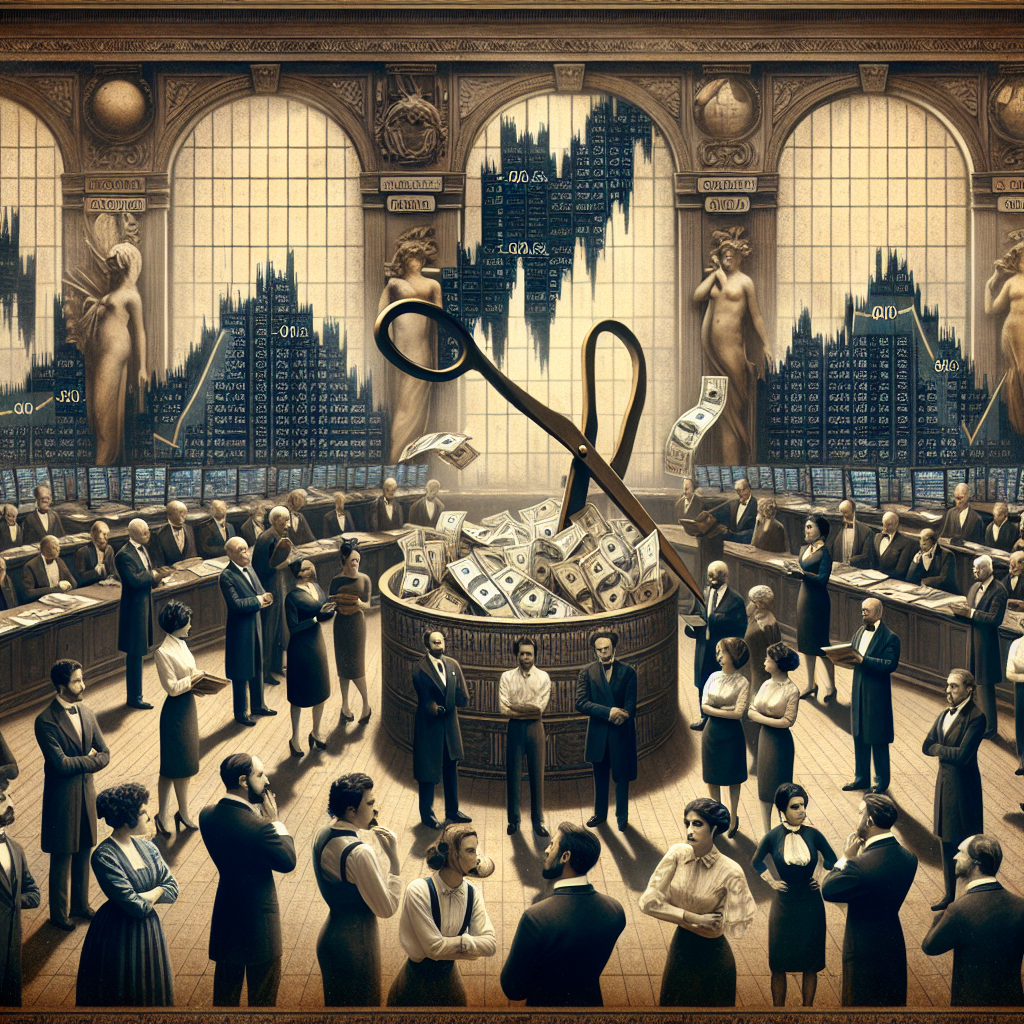

Renowned investor Steve Eisman, known for his prescient prediction of the 2008 housing market collapse, has boldly asserted that the Federal Reserve should refrain from reducing interest rates amidst signs of economic resilience and declining inflation.

Eisman believes that rate cuts by the Fed would be counterproductive, leading to the resurgence of asset bubbles.

He cautions that such bubbles could pose a significant threat to financial stability.

His argument stems from the observation that the economy remains robust, as evidenced by strong consumer spending, improving labor markets, and robust corporate earnings.

Additionally, inflation has moderated from its recent peak, indicating that rate hikes implemented by the Fed have been successful in taming inflationary pressures.

Eisman contends that further rate cuts could fuel excessive risk-taking in markets, as investors seek higher returns amid low-interest rates.

This behavior could lead to speculative bubbles in asset classes such as stocks, real estate, or cryptocurrencies.

Ultimately, Eisman believes that a “stay-put” approach by the Fed would be the wiser course of action.

He urges the decision-makers to prioritize maintaining financial stability rather than prematurely stimulating growth and potentially sowing the seeds for future economic imbalances.

- NEWS SENTIMENT CHECK

- Overall sentiment:

negative

Positive

Negative

“My actual fear is that if the Fed were actually to cut rates, the market becomes bubblicious and then we have a real problem”

“Eismann told CNBC.”