- ORIGINAL NEWS

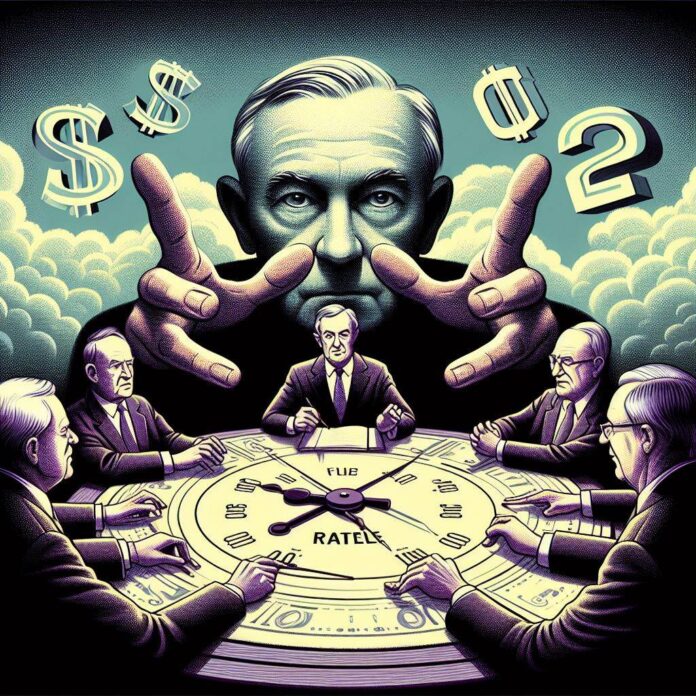

Fed officials expressed caution about lowering rates too quickly at last meeting, minutes show

- SUMMARY

The Federal Reserve (Fed) recently met to discuss interest rates and inflation.

They decided to keep interest rates unchanged and indicated that they won’t cut rates until inflation is under control.

The Fed’s goal is to maintain stable prices and economic growth, and raising interest rates can help manage inflation.

Inflation had reached record highs in mid-2022, but it has been coming down since then.

However, the Fed wants to make sure inflation is consistently at their target of 2% before lowering rates.

Concerns remain about inflation moving too quickly.

There is also uncertainty about how long the Fed needs to maintain a restrictive monetary policy.

Officials also discussed managing their bond holdings on the balance sheet and the appropriate level of reserves once they begin reducing interest rates.

Despite concerns about inflation and the economy, the U.S. labor market continues to grow.

Economic data points to a potential GDP growth of 2.9% in the first quarter of 2023, which is higher than predicted.

As a result, traders have adjusted their expectations for rate cuts this year.

Previously, a rate cut in March was expected, but now it’s being pushed to June.

The number of expected cuts for the year has also decreased from six to four.

- NEWS SENTIMENT CHECK

- Overall sentiment:

neutral

Positive

“The meeting summary did indicate a general sense of optimism that the Fed’s policy moves had succeeded in lowering the rate of inflation.”

“Multiple officials in recent weeks have indicated a patient approach toward loosening monetary policy.”

Negative

“The discussion came as policymakers not only decided to leave their key overnight borrowing rate unchanged but also altered the post-meeting statement to indicate that no cuts would be coming until the rate-setting Federal Open Market Committee held “greater confidence” that inflation was receding.”

“Participants generally noted that they did not expect it would be appropriate to reduce the target range for the federal funds rate until they had gained greater confidence that inflation was moving sustainably toward 2 percent.”