- ORIGINAL NEWS

Biden’s ‘billionaire tax’ takes aim at the super-rich — but can a wealth tax work in reality?

- SUMMARY

Wealth taxes are back in the spotlight as governments worldwide seek ways to address rising wealth inequality and fund public services.

Recently, President Biden proposed a new “billionaire tax” on Americans with over $100 million.

A wealth tax is a broad-based tax on all or most of an individual’s assets, such as cash, property, and investments.

Unlike income tax, which targets yearly earnings, or capital gains tax, which taxes profits from asset sales, a wealth tax attempts to account for a person’s overall financial status.

The idea of a wealth tax gained prominence in Europe decades ago, but its implementation has declined over time due to questions about its effectiveness and the shift towards lower tax rates for the wealthy.

However, the issue has resurfaced as concerns about wealth disparity mount.

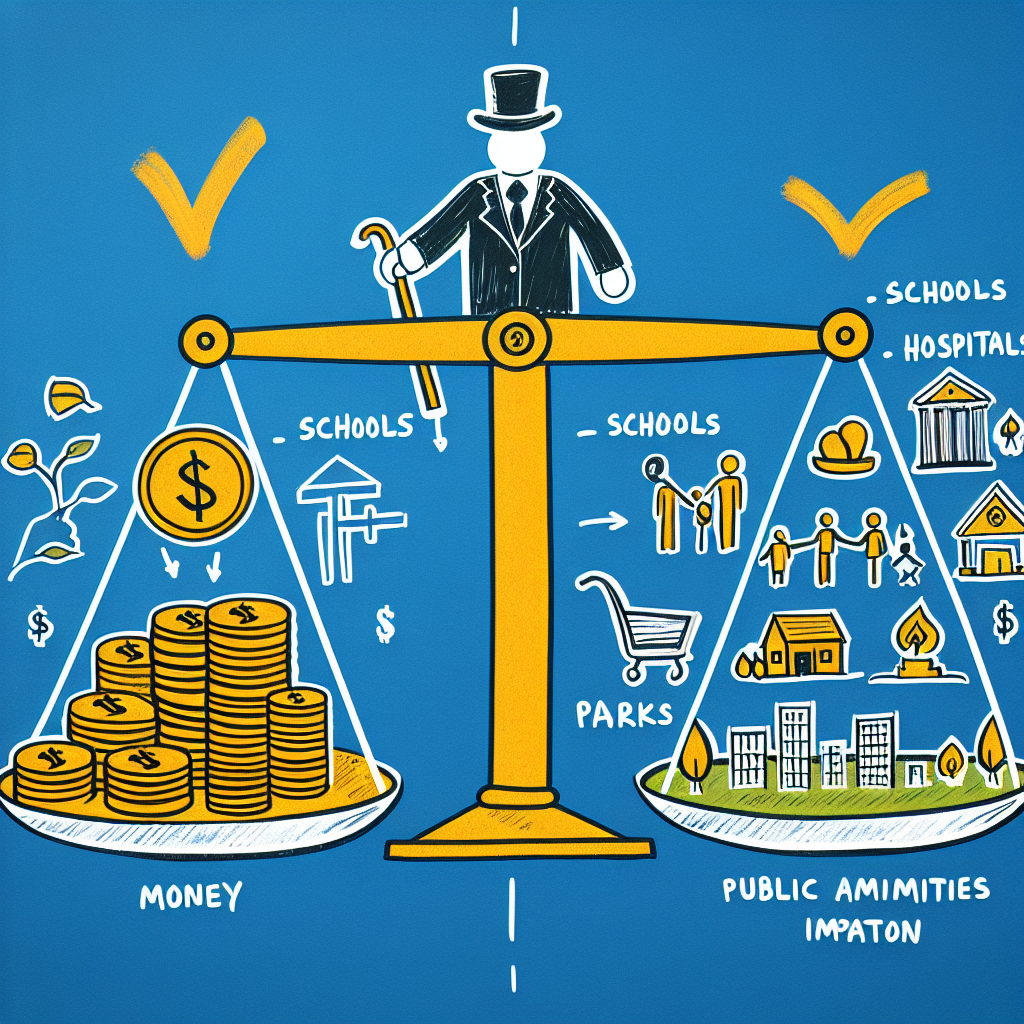

Proponents of wealth taxes argue that they can generate substantial revenue to fund crucial public programs, such as healthcare, education, and climate initiatives.

They also maintain that it ensures that the wealthy, who benefit significantly from society’s resources, pay their fair share of taxes.

However, it’s essential to note that wealth taxes face challenges in practice.

There are difficulties in determining the value of assets and ensuring compliance.

Critics worry that such a tax may lead to capital flight, as wealthy individuals relocate to more favorable tax jurisdictions.

While implementing wealth taxes can be complex and subject to debate, they offer a potential mechanism to address the growing wealth gap and provide additional resources for common good initiatives.

- NEWS SENTIMENT CHECK

- Overall sentiment:

neutral

Positive

“In early 2024, a growing network of so-called Patriotic Millionaires signed an open letter to world leaders, calling for higher taxes for the wealthy.”

“Groups like Patriotic Millionaires say that is part of their stated aims.”

“Last month, global finance ministers meeting for a G20 summit in Brazil said they were exploring plans for a global minimum tax on the world’s 3,000 billionaires to ensure the hypermobile super-rich 0.1% pay their fair share to society.”

Negative

“Critics point to the increased risk of a wealth exodus among the highly mobile super-rich, including to tax havens, which they say undermines original efforts to boost government coffers.”

“Tax specialists note, however, that even well-designed wealth tax policies can be hard to enforce in practice, with questions arising over which assets should be taxed and who should be responsible for evaluating their value.”

“Researchers are divided on the risks of capital flight from a wealth tax, with some contending that cash outflows would be limited.”