- ORIGINAL NEWS

El-Erian, Krugman and other economists have very different opinions on China’s struggling economy

- SUMMARY

Alright!

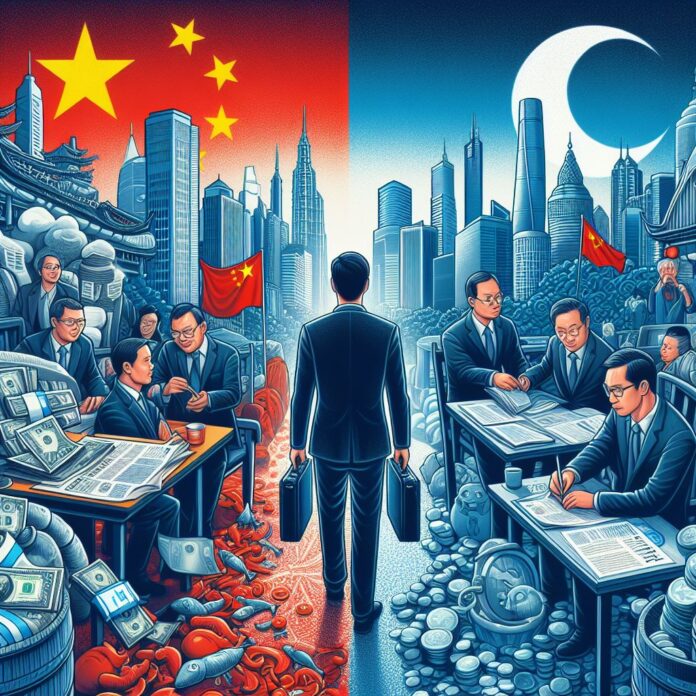

Here’s a summary for you: There is a growing debate among economists and investors about the state of China’s economy.

Some, like Nobel laureate Paul Krugman and hedge fund manager Kyle Bass, are bearish on China’s prospects, citing factors such as a struggling stock market, deflation, a collapsing property market, and poor leadership.

Others, such as the Institute of International Finance and Clocktower Group, are more optimistic, pointing to China’s policy capacity and resilience in certain economic sectors.

China’s economy has been facing headwinds, including a shaky stock market, deflation, and a struggling property sector.

Leading economists like Paul Krugman are pessimistic, predicting stagnation and disappointment due to poor leadership and high unemployment.

China’s real estate troubles, accounting for a significant portion of its GDP, have raised concerns about defaults and a decline in growth rates.

On the other hand, others like Marko Papic and JPMorgan Private Bank see potential for growth in China’s global manufacturing role and resilience in certain economic segments.

The debate centers on China’s ability to overcome these challenges and maintain its growth trajectory, showcasing the division between China bulls and bears.

- NEWS SENTIMENT CHECK

- Overall sentiment:

negative

Positive

“Nobel laureate Paul Krugman has been among some of the most bearish voices toward China, saying the country is entering an era of stagnation and disappointment.”

“The Institute of International Finance said Beijing has the policy capacity to push China’s economy toward its growth potential and stuck to its above consensus forecast for 2024 growth at 5%, in a recent blog post.”

Negative

“China’s economy is sputtering. Its property market is crumbling, deflationary pressures are spreading across the nation, and its stock market has weathered a turbulent ride so far this year, with the country’s CSI 300 index erasing some 40% of its value from its 2021 peaks.”

“Slew of downbeat data has consequently triggered a wave of skepticism toward the world’s second-largest economy.”